Detrended Rhythm Oscillator (DRO)

The purpose of this indicator is to visualize and check if there is a common rhythm or beat in the dataset of interest.

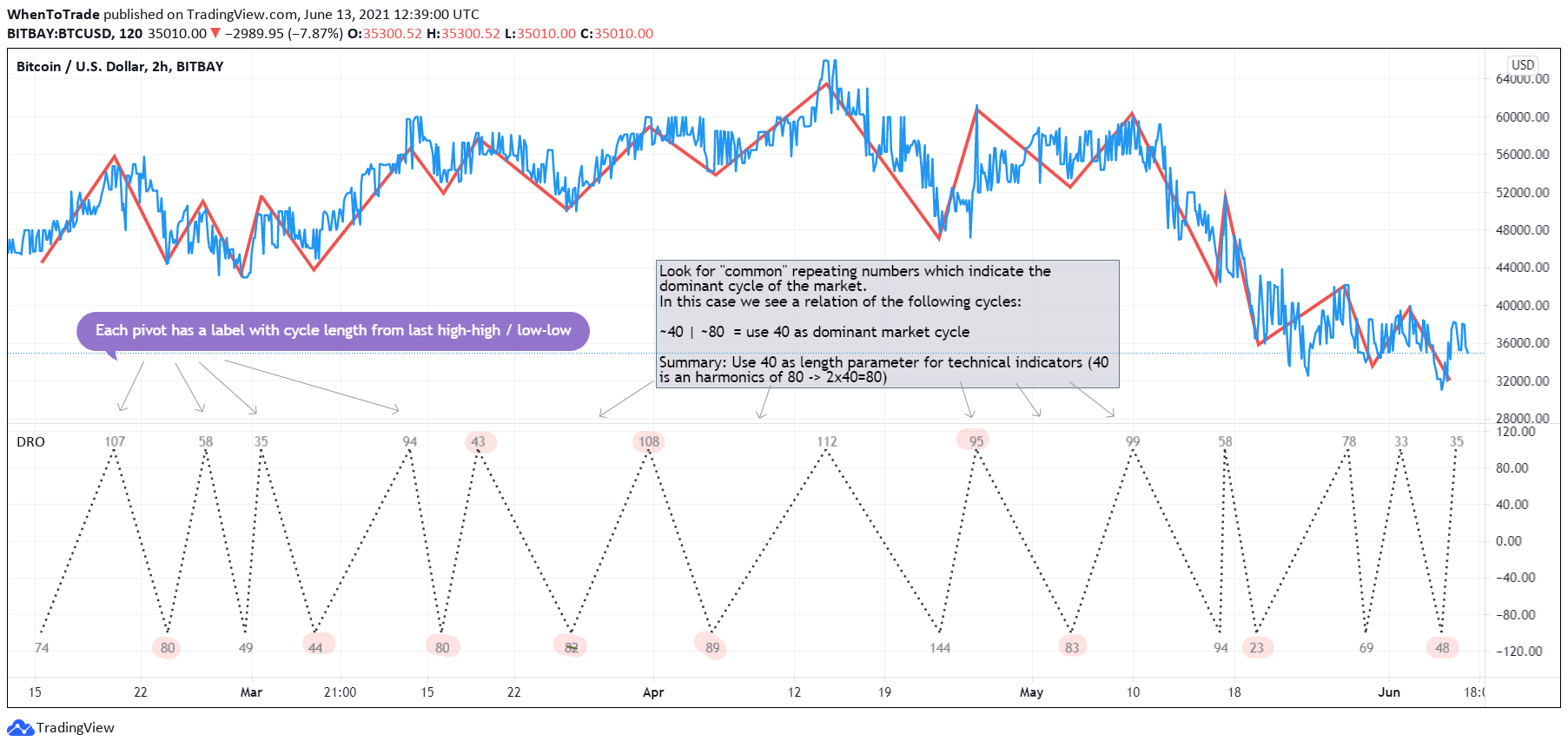

Chart: 120m Bitcoin chart visualizing the dominant rhyhtm of 40/80 bars with the DRO indicator

TradingView chart: https://www.tradingview.com/x/WYBQLz9D/

Direkt link to TradingView Indicator:

https://www.tradingview.com/script/nzvqcuSh-Detrended-Rhythm-Oscillator-DRO/

Overview and Background

A common way to capture the current dominant cycle length is to detrend the price and look for common rhythms in the detrended series. A common approach is to use a Detrended Price Oscillator ( DPO ). This is done in order to identify and isolate short-term cycles.

A basic DPO description can be found here.

Improvements to the standard DPO

The main purpose of the standard DPO is to analyze historical data in order to observe cycle's in a market's movement. DPO can give the technical analyst a better sense of a cycle's typical high/low range as well as its duration. However, you need to manually try to "see" tops and bottoms on the detrended price and measure manually the distance from low-low or high-high in order to derive a possible cycle length.

This indicators adds the following improvements:

1) Using a DPO to detrend the price (can be turned on or off)

2) Indicate the turns of the detrended price with a ZigZag lines to better see the tops/bottoms

3) Detrend the ZigZag to remove price amplitude between turns to even better see the cyclic turns ("rhythm")

4) Measure the distance from last detrended zigzag pivot (high-high / low-low) and plot the distance in bars above/below the turn

Now, you we can clearly see the rhythm of the dataset indicated by the Detrended Rhythm Oscillator including the exact length between the turns. This makes the procedure to "spot" turns and "measure" distance more simple for the trader.

How to use this information

The purpose is to check if there is a common rhythm or beat in the underlying dataset. To check that, look for recurring pattern in the numbers. E.g. if you often see the same measured distance, you can conclude that there is a major dominant cycle in this market. Also watch for harmonic relations between the numbers. So in the example above you see the highlighted cluster of detected length of around 40 and 80. There three numbers all have a harmonic relation to 40.

Once you have this cyclic information, you can use this number to optimize or tune technical indicators based on the current dominant cycle length. E.g. set the length parameter of a technical indicator to the detected harmonic length with the DRO indicator.

Disclaimer:

This is not meant to be a technical indicator on its own and the derived cyclic length should not be used to forecast the next turn per se. The indicator should give you an indication of the current market beat or dominant beats which can be use to further optimize other oscillators which require length settings as input pararmeters.